Intellectual property (IP) stands out in a knowledge-based economy – usually regarded to allegedly be more important than real assets—even in terms of what is an asset to businesses.

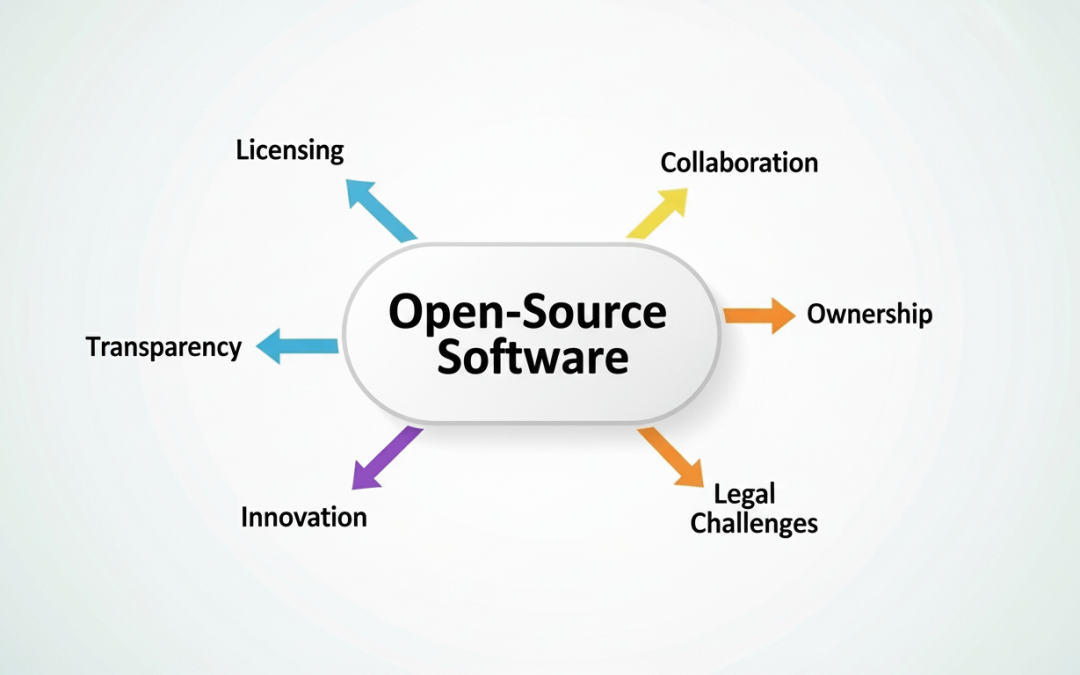

Businesses thrive not only by having products or services, but also by having strong ideas, innovations, and creative expressions that constitute themselves. These include copyright, which protects written works, and trademarks, which secure brand identities, really maximizing the market value of an organization.

But before enjoying such privileges, one must first understand the IP valuation process: evaluating the financial worth of that intellectual property.

What is IP Valuation?

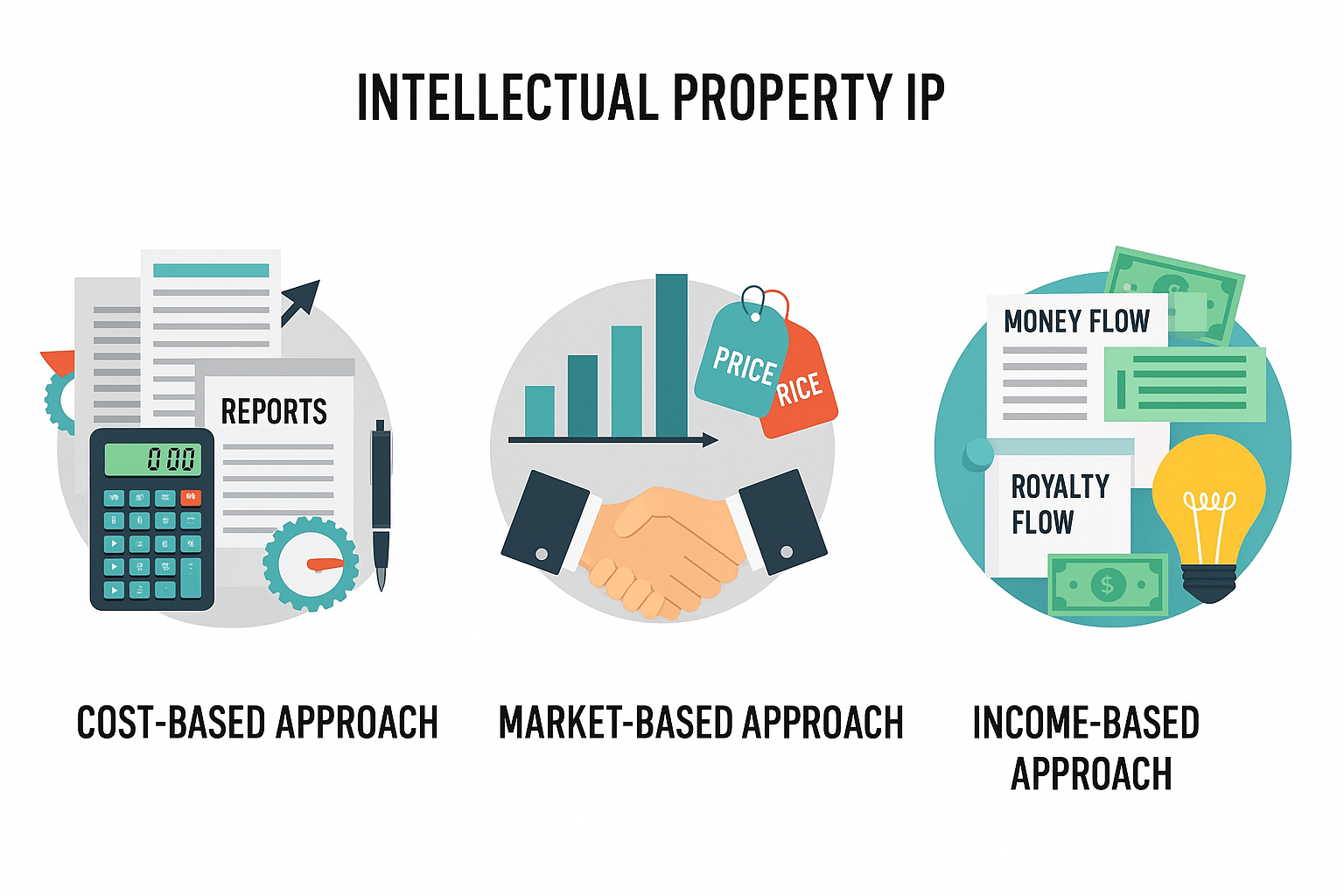

Valuation encompasses IP’s value by bringing money into intangible assets—patents, copyrights, trademarks, and trade secrets.

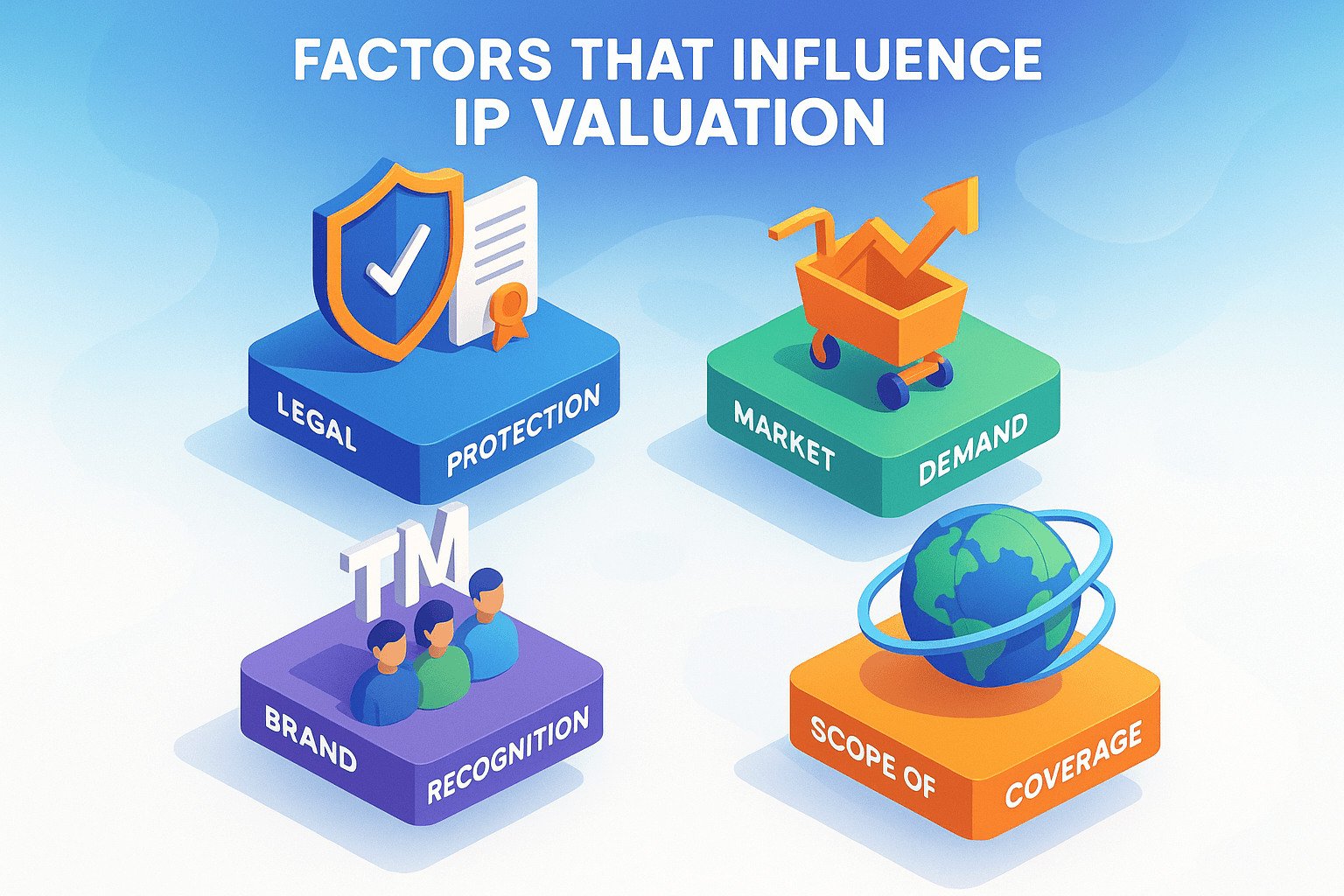

The value of identifying such intangible assets lies not as it does with physical properties, though, in such factors as legal protection, potential income, and brand recognition.

Valuations thus counseled can help any participant in:

- Licensing deals

- Mergers and acquisitions

- Fund raising

- Litigation matters in which infringement is contended